SEBI registration no. : ARN-113510

Expiry : 3rd AUG 2025

IRDA license no. : IMF186644360120180192

Expiry : 24th JAN 2027

Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

Policymakers have been pushing to open up India’s financial sector to more private firms. But it is government-owned firms in which the Indian public still reposes its faith. Take life insurance, which was opened up to private players 14 years ago.

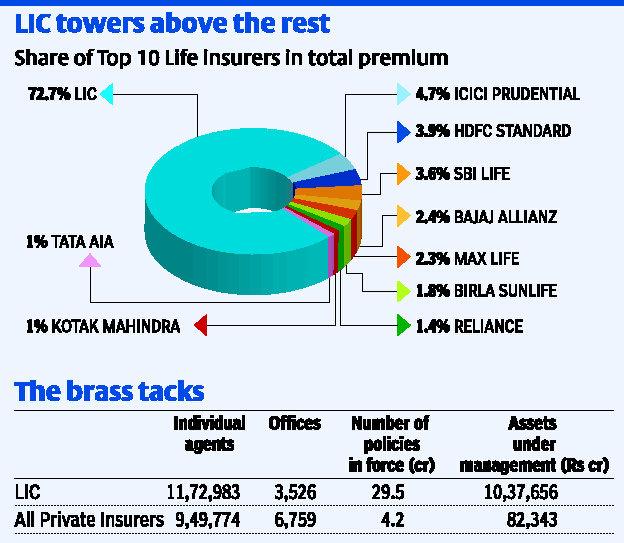

Though nearly two dozen new private sector players have entered the fray since then, the Life Insurance Corporation of India still dominates the sector with a 73 per cent share in all new premiums collected. Of the total 34-odd crore policies in force in 2012-13, 29 crore are from LIC. In the last five years, LIC has gained 2 percentage points in market share from private players. After the 2008 stock market debacle, unit linked plans that private players offered suffered a setback, with investors moving back to traditional plans — an LIC stronghold.

While the LIC towers over the life insurance market, 23 private players fight intensely to divide up the rest of the pie. The largest of them, ICICI Prudential, has a 4.7 per cent share in new premiums. Only five other players have more than 2 per cent market share. Trust, access and safety seem to be paramount in the customer’s mind when choosing an insurance product; and LIC seems to score well on all these.

LIC has the largest number of offices and feet on the street in the market. LIC has on its rolls, more individual agents than all private insurers put together. In 2012-13, LIC employed 11.72 lakh field agents, while private insurers together employed no more than 9.49 lakh. LIC receives nearly 96 per cent of its new business from its individual agents. For private insurers, nearly half their new business comes from corporate agents and only 40 per cent through individual agents.

The other big factor favouring LIC, of course, is the implicit sovereign guarantee backing up its policies. As life insurance products are long term in nature, with investors paying premia for terms as long as 30 years, they obviously value staying power.

But in spite of such a sizeable business, LIC is no more profitable than its next biggest rival — ICICI Prudential. LIC reported a net profit of 1,437 crore in 2012-13, while ICICI Prudential Life Insurance earned 1,496 crore. The total assets under management for all life insurers is about 30 lakh crore, of which LIC manages 26 lakh crore.

Despite managing such a large corpus, LIC has a modest capital base. While ICICI Prudential has a share capital base of 1,429 crore, even after adding its reserves and surpluses, LIC sports just 500 crore of net worth.

That’s not surprising given that LIC distributes nearly all its earnings as dividends to the Government of India, year after year.

SEBI registration no. : ARN-113510

Expiry : 3rd AUG 2025

IRDA license no. : IMF186644360120180192

Expiry : 24th JAN 2024

Copyright © 2026 Design and developed by Fintso. All Rights Reserved